Laatst geüpdated op maart 22, 2024 door Wendy Bogers

Can I, as a foreigner, start a business in The Netherlands?

It is definitely possible to start a business in The Netherlands as a foreigner. Even though there are some additional requirements, especially when you are living abroad. If you are not an EU/EEA or Swiss citizen you might for example need a work permit. This is not needed if you are currently living in the EU/ EEA or Switzerland.

Would you also like to move to The Netherlands? Then as a non EU/EEA or Swiss citizen you might need a visa or a residence permit. You can read more on the website of the Dutch Government to discover whether you might need a work permit, visa or a residence permit.

Besides a work permit, visa or a residence permit you might also need to apply for a business bank account (IBAN). This is needed when you are an entrepreneur located outside the Single Euro Payment Area (SEPA) Zone. A business bank account will allow you to easily and securely make national and cross border euro payments.

Note that the process for applying for a business bank account can take some time so it is useful to start work that as soon as possible. You can already check on the website of the Dutch Banking Association if you are eligible to apply for an account.

Is The Netherlands a good place to start a business?

There are multiple reasons for starting a business in The Netherlands. The main advantages are the innovative business climate and the tax benefits compared to other countries. Furthermore, certain legal business structures that you might choose for your company such as the Dutch BV (private limited company) and the Dutch NV (public limited company) are suitable for engaging in business activities.

They also make a professional impression. After all, these companies are formally incorporated by the notary and need to be registered at the Dutch Chamber of Commerce. They also limit the potential liability so you can protect yourself.

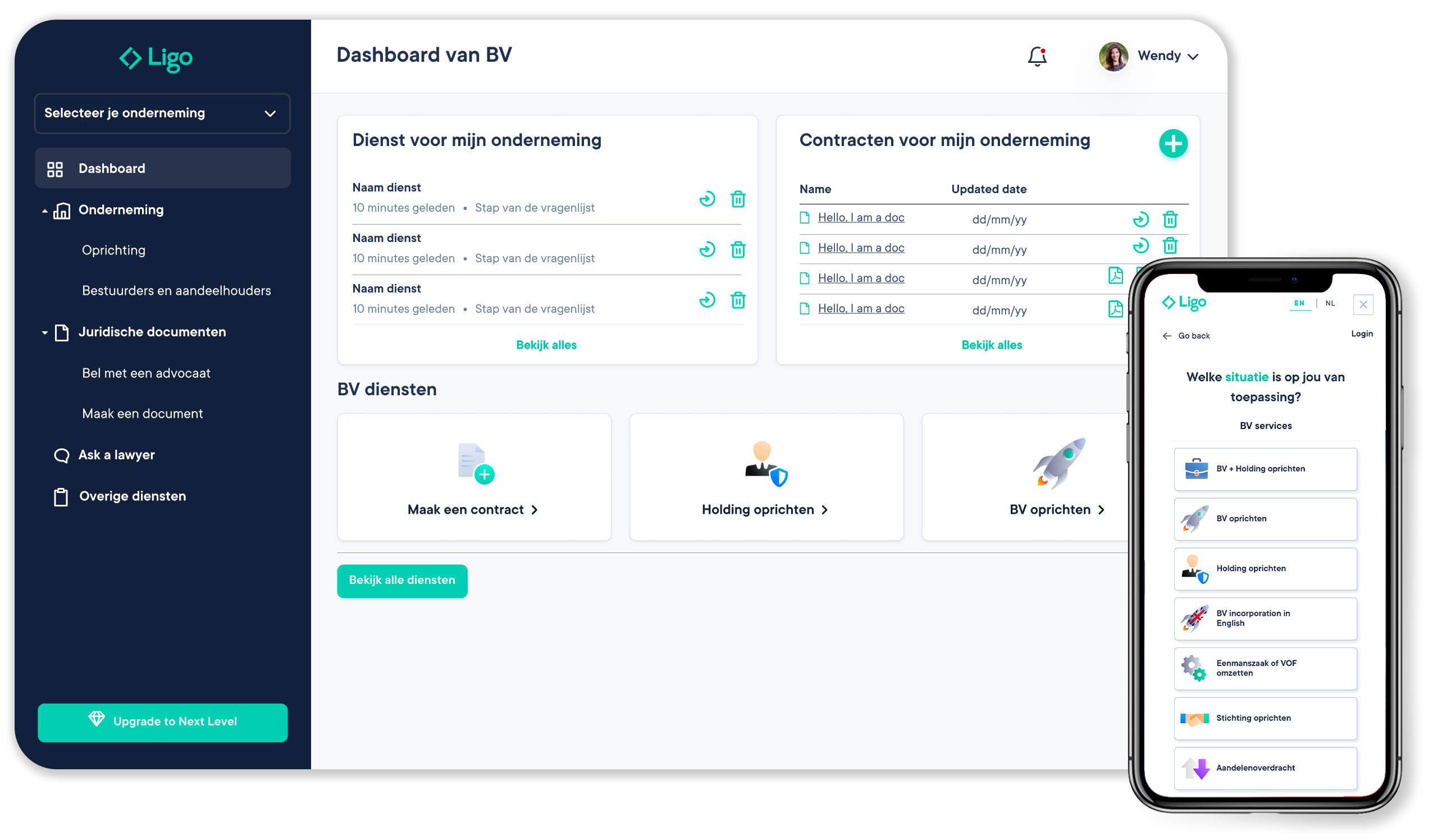

Een BV oprichten met gratis advies van de Ligo specialisten?

Meer dan 100.000+ ondernemers kozen voor de oplossing van Ligo

Do I need to write a business plan or strategy for my business?

Whereas it might not be mandatory to write a business plan for your business, it is always recommended to do so. A business plan lays out everything that you are planning to do with your company, for example, the business structure, your goals, how you are going to reach these goals and a financial plan.

Having such a business plan is also beneficial if you would like to attract investors. Investors can review your business plan and assess whether your company is worth investing in.

What structure would I like my company to be?

In The Netherlands there are several forms that your company can take. Would you like to operate in The Netherlands and be an entrepreneur? Then you must choose a legal business structure.

In The Netherlands there are legal business structures with and without legal personality. Legal personality means that the business has its own rights and obligations. There is an important difference in liability between these two.

- If your company has a business structure without legal personality, you will be fully liable with your private assets for all debts your company incurs.

- If your company has a legal business structure with legal personality you have limited responsibility, since those liabilities are taken on by the legal personality. Apart from some exceptions, your company is liable for its own debts.

To start a business in The Netherlands you must choose a structure that suits you best. We understand that this is not an easy task. To help you out, we have put together a handy overview.

Download de gratis Rechtsvorm Gids & lees alles over het kiezen van de juiste rechtsvorm

Dutch business structures without legal personality

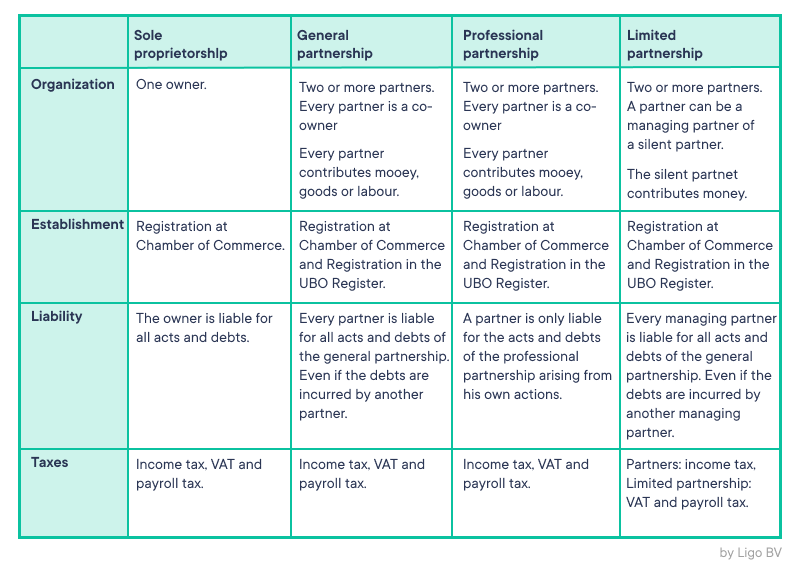

The four different Dutch legal business structures without legal personality are:

- Sole proprietorship

- General partnership (vennootschap onder firma)

- Professional partnership (maatschap)

- Limited Partnership (commanditaire vennootschap, cv)

All of these legal business structures have no starting capital requirements. We have set out the differences between these structures in the table below.

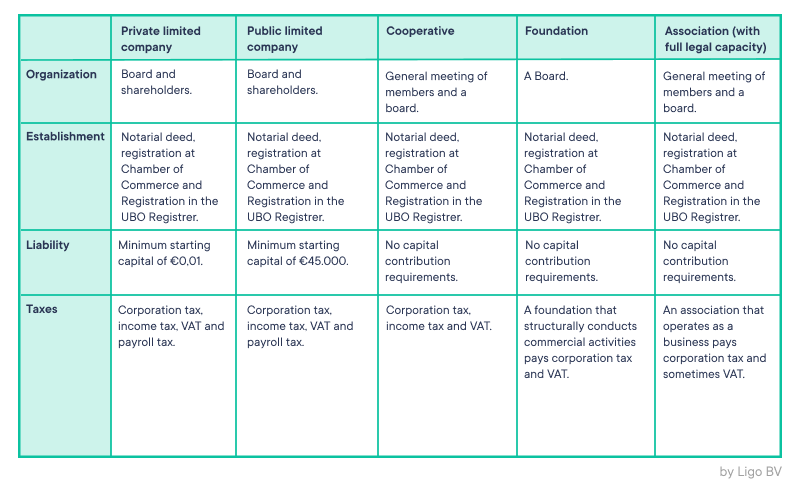

Dutch business structures with legal personality

The five different Dutch legal business structures with legal personality are:

- Private limited company (besloten vennootschap, BV)

- Public limited company (naamloze vennootschap, NV)

- Cooperative (coöperatie)

- Foundation (stichting)

- Association (with full legal capacity) (vereniging met volledige rechtsbevoegdheid)

Differences between these structures can be found in the table below.

Note that working as a self employed professional, also known as a zzp’er, or freelancer are not legal business structures in The Netherlands, but are a sole proprietorship. Would you like to work as a self employed professional? Then you might would like to choose for the legal business structure private limited company (the Dutch BV).

We can imagine that after this overview you might still have questions about all the different legal business structures. Don’t worry! Ligo is there to help you choose the best legal business structure for your company.

Do you already know which legal business structure you want to choose, but don’t you know where to start? If you, for example, choose to start up a BV at Ligo, we will help you with everything you need.

What taxes do I need to pay?

In The Netherlands, you do not need to register at the Dutch Tax Authorities yourself. Once you have completed your registration at the Dutch Chamber of Commerce, the Chamber will register your company with the Tax Authority.

When they have processed your application, you will receive your personal number to file your taxes with and a number you need for correspondence with your clients.

Which taxes you have to pay to the Dutch government depends on the legal business structure you choose for your business. We will give you a brief overview of some of the different taxes in The Netherlands.

- Income tax. You have to pay income tax on your salary when you are working in The Netherlands. If you are considered an entrepreneur (sole proprietorship) for income tax purposes, you have to pay income tax on your profit.

- VAT (Value Added Tax). These taxes are in The Netherlands also known as BTW. The VAT is paid over your revenue and it is calculated in the price of your goods and services. The VAT has three different rates: 0%, 9% and 21%.

- Payroll tax. The payroll taxes are withheld from the salaries of your employees by you as employer.

- Corporate tax. If your company with legal personality has a taxable profit you must pay corporate tax.

- Dividend tax. You are required to pay these taxes if you issue dividends (in case of a BV or NV).

Do I need to register at the Dutch Chamber of Commerce?

All Dutch companies in The Netherlands need to be registered at the Dutch Chamber of Commerce. Once you register there, the Chamber of Commerce (KVK) will register you at the Dutch Tax Authorities.

This gives you, but also other companies that you might be doing business with, some legal certainty. In this register you can see who can act on behalf of a certain company and whether the company might be bankrupt.

The costs of this registration are only € 51,95 (2022). If you decide for example to start up a BV at Ligo, we will help you with the registration at the Dutch Chamber of Commerce.

What is an UBO registration?

In The Netherlands, many organisations are required to register their ultimate beneficial owners (UBOs). An UBO is for example a person who owns more than 25% of the shares in a private limited company (the Dutch BV). You must determine yourself who in your company is a UBO. You will risk getting a fine if you do not register your UBOs.

What branche requirements do I need to take note of?

In some industries there are branche requirements that you need to keep in mind when starting a business. Therefore, it is important to investigate what branche you would like your company to be in and what requirements are set for this branche.

Examples of these requirements are hygienic requirements for the hospitality business or required certificates or permits.

Besides that, you should also make sure that you have a look at, for example, the plan for zoning at the location of your company as well as the requirements for the products you would like to distribute.

What risks do I need to protect myself from?

When starting a business it is important to map out all the risks that you or your company might face. By doing so, you will discover what types of insurance are important.

When you decide to live in The Netherlands some insurances are mandatory such as your personal health insurance. However, there are also insurances that are important with regards to your company.

These are, for example, liability insurance or disability insurance. Check out our partnership with Harper for discounts on plenty of insurances. Unfortunately, this page can only be consulted in Dutch.

Is my company required to have general terms and conditions?

If you would like to protect your company against claims from consumers or business partners it is highly advised to have general terms and conditions. This way, you can protect yourself and your company from liability when something goes wrong.

Problems can, for example, arise when delivering a good or with payments for goods or services. By clearly stating what happens in these circumstances, you can avoid liability in case problems arise.

You can create these terms and conditions at Ligo! By generating the general terms and conditions that are specifically aimed at your company at Ligo, you are also ensured that they can be legally enforced.

How do I take care of my business administration?

Besides a financial and business plan, you also need to take care of your administration. This is mandatory by law. This administration gives you insight into for example the taxes you need to pay. You can do this yourself, but you can also choose to get a bookkeeper. This way, you can focus on your business.

Besides this, you should not forget to keep track of the administration of the DGA (director-major shareholder). This person needs to receive a minimum salary of €56.000 each year. This is set by law to avoid abuse of tax benefits.

Is your company not able to pay this salary to the director-major shareholder? No worries! At Ligo we help you with the request (to the Dutch tax authorities) to lower this amount.

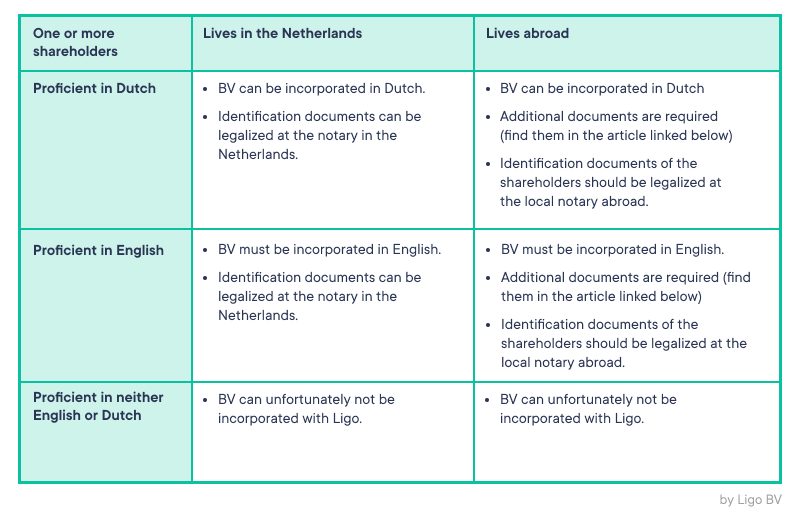

Are there any additional steps I need to take as a foreign entrepreneur?

When you choose your company to have legal personality, the company needs to be incorporated by a notary. In order to incorporate your business in The Netherlands as a foreign entrepreneur, there are indeed a few additional steps you will need to take.

To make sure you do not miss a step we have set them out below.

How much does starting a business in The Netherlands cost?

Depending on what entity you would like your business to be, the costs of starting up a business vary. When you are setting up a sole proprietorship, no notary will be involved which significantly cuts the costs.

However, as mentioned before, this sole proprietorship is a risk with regards to your personal liability. Therefore, the Dutch BV is very popular.

The main costs of a BV can be found in the notary fees. These fees can add up to € 1500 as each notary can set the price themselves. On top of that you will need to pay a registration fee at the Chamber of Commerce of € 51,95 (2022).

However, if you were to decide to start up a BV, this can be done at Ligo for as little as €549! This price does not include the registration fee at the Chamber of Commerce.

Telefonisch overleggen over jouw situatie?

Questions?

Do you have any further questions about starting a business in The Netherlands? Feel free to contact us! We are available seven days a week. You can reach us by phone on working days between 9:00h and 18:00h on 020-3031043 for free advice.

In addition, from Monday to Friday we are available from 9:00h to 22:00h via our online chat. On Saturdays, our chat is available from 10:00h to 18:00h.

- Rylee Startup Story - maart 10, 2023

- Juridische scan voor ondernemers - maart 10, 2023

- Wetswijzigingen ondernemers juli 2022: wat verandert er per 1 juli? - maart 9, 2023